Source: Why I Dissented – Neel Kashkari – Medium (President of the Federal Reserve Bank of Minneapolis)

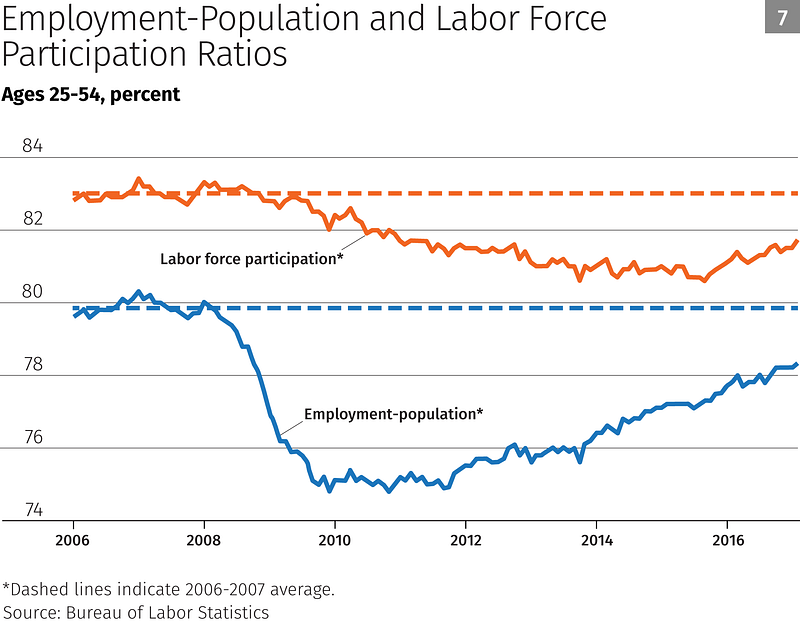

In summary, I dissented because the key data I look at to assess how close we are to meeting our dual mandate goals haven’t changed much at all since our prior meeting. We are still coming up short on our inflation target, and the job market continues to strengthen, suggesting that slack remains. Once the data do support a tightening of monetary policy, I would prefer the next policy move by the FOMC [Federal Open Market Committee] to be publishing a detailed plan that explains how and when we will begin to normalize our balance sheet. Once we put that plan in place, and we see the market reaction to it, we can return to using the federal funds rate to remove monetary accommodation when the data call for it.

…

Monetary policy is currently somewhat accommodative. There don’t appear to be urgent financial stability risks at the moment. There is great uncertainty about the fiscal outlook. The global environment seems to have a fairly typical level of risk. From a risk management perspective, we have stronger tools to deal with high inflation than low inflation. Looking at all this together led me to vote against a rate increase.