Source: On Inequality and Risk Capacity | The Information, by Sam Lessin

The biggest factor causing inequality is the ability of people to take risk. Those who have already scored a big success have more capacity to take further risks than those who haven’t. … coupled with a changing landscape of the types of risk available to people and their capacity and willingness to take risk.

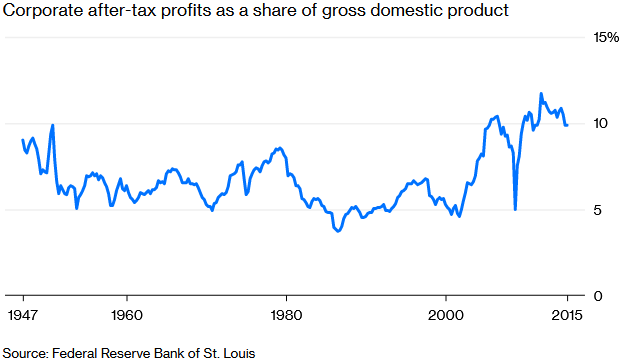

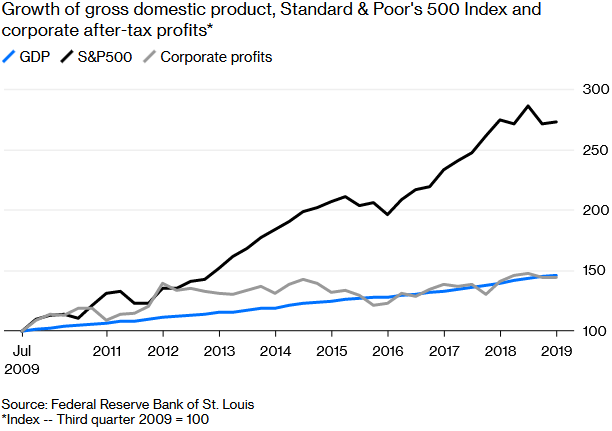

While I am sure [technology and unequal access to “opportunity”] play a role, I am convinced that they are not the major source of growing inequality in the U.S. The real cause is the compounding advantage that some people have in their ability to take certain types of financial risk in a world where access to capital is commoditized. Real returns come from high-variance, low-probability outcomes.

A smarter, stronger and harder-working person might do better than their neighbor, but at most by a few multiples, not orders of magnitude. Differences in knowledge might at first blush seem like they can provide compounding advantage … But the reality is that knowledge tends to diffuse quite rapidly. It is hard to keep an idea or invention private forever to your own advantage… So, a great idea or a unique piece of information you figure out might provide some advantage for a while, but it is generally not sustainable or compounding.

For most, the risk-taking doesn’t pay off, and these people end up worse off than their non-risk-taking neighbors. … For a minority, however, imagine that their risk taking pays off, and they get dramatically richer than their neighbors… Unlike the first-round risk-taking losers, the winners can now afford to take more and more risks. … over time, we end up in a society where some people can afford to take rational risks with time and capital, but most cannot.

Consumer protections have their place. But there is no question that regulations, which disincentivized companies from going public quickly—and bar unaccredited investors from taking financial risks or investing in funds which do—drive inequality. In the name of protecting people we have set up a world where—quite literally—in order to have access to the best performing investments you need to already be rich.

There will still be inventors, and there will still be hard workers in our future. But as we come to grips with the fact that in modern times economic outcome compounds less on innovation and work, and more on risk taking, either our national identity is going to have to dramatically shift, or we are going to have to think about how we evolve our social structures.